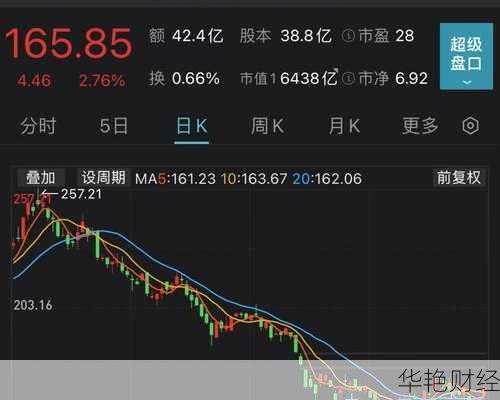

五粮液股票行情,五粮液股票行情实时

Here's an analysis of Wuliangye's (000858.SZ) stock performance based on recent data:

Wuliangye (000858.SZ) is a Shenzhen Stock Exchange-listed company. The real-time stock information provides an overview of its current market status.

Stock Information Snapshot (as of February 8, 2025):

Open: The opening price on February 8, 2025.

High: The highest price reached during the trading day.

Low: The lowest price reached during the trading day.

Previous Close: The closing price of the previous trading day.

Volume: The total quantity of shares traded.

Amount: The total monetary value of the shares traded.

Swing: The percentage difference between the high and low prices during the trading day.

Turnover Rate: The percentage of shares that have been traded relative to the total number of shares.

Total Market Value: The overall valuation of the company based on its share price.

Circulating Market Value: The market value of shares available for trading.

Price-to-Book Ratio (PB): A ratio used to compare a stock's market value to its book value.

Price-to-Earnings Ratio (TTM): The ratio of a company's stock price to its earnings per share over the past 12 months.

Trading Details (as of December 20, 2024):

Price: 143.21

Change: -0.34

Percentage Change: -0.24%

Previous Closing Price: 143.55

Opening Price: 143.70

High: 144.47

Low: 142.72

Volume: 17.3 ten thousand shares

Turnover: 24.79 billion

Total Market Value: 555.9 billion

Tradable Market Value: 555.9 billion

Amplitude: 1.22%

Turnover Rate: 0.45%

Price-to-Book Ratio: 4.08

Price-to-Earnings Ratio: 17.21

Financial Performance:

In 2023, Wuliangye achieved a total operating income of 83.272 billion yuan, marking a 12.58% year-on-year increase, and a net profit attributable to shareholders of the listed company of 30.211 billion yuan, representing a 13.19% year-on-year increase. The company successfully achieved its initial operating targets for the year. The company's total assets reached 165.433 billion yuan by the end of 2023, an 8.26% increase from the beginning of the year, mainly due to an increase in current assets. Shareholders' equity totaled 132.349 billion yuan, a 13.42% increase from the beginning of the year, with the equity attributable to the parent company's shareholders amounting to 129.558 billion yuan, a 13.62% increase from the beginning of the year. The company's earnings per share were 7.783 yuan/share, a 13.19% increase.

Q3 2024 Report:

Wuliangye: 2024 Third Quarter Report (2024-10-31).

Market Observations and News (as of February 8, 2025):

Industry Forecast: The China Alcoholic Drinks Association (中国酒业协会) predicts that the white spirits (baijiu) sector will perform better in 2025 than in 2024.

Lunar New Year (Spring Festival) Activity: Wuliangye promoted blessings for the holiday. The company competed in the Spring Festival market, showcasing innovation.

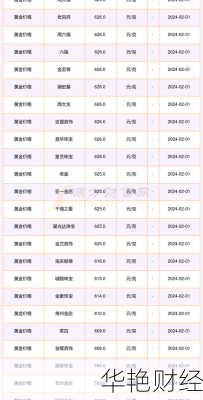

Baijiu Market Trends: Post-holiday, baijiu prices are recovering, with several companies releasing annual performance forecasts. During the Spring Festival, sales increased, and mid- to high-end products remained strong. Some distributors discussed Spring Festival sales, noting that茅台(Maotai) increased,五粮液(Wuliangye) remained stable, and 1573 experienced a slight decline.

Company Initiatives: 五粮液(Wuliangye) is steadily starting the year, and 川南(Chuan Nan) is jointly building a world-class premium baijiu cluster.

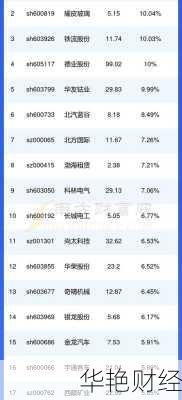

Stock Performance: On the first trading day after the holiday, baijiu stocks showed a weakening trend.

评论留言