南京医药股票(南京医药股票怎么样)

Here's a comprehensive analysis of Nanjing Pharmaceutical Co., Ltd. (600713.SH), incorporating its stock performance, financial health, market position, and potential future prospects.

Overview of Nanjing Pharmaceutical (600713.SH)

Nanjing Pharmaceutical Co., Ltd. is a major pharmaceutical distribution company based in Jiangsu, China. It is listed on the Shanghai Stock Exchange. The company's primary activities include pharmaceutical distribution, retail, and logistics. As a state-owned enterprise, it is also subject to state-owned enterprise reform initiatives.

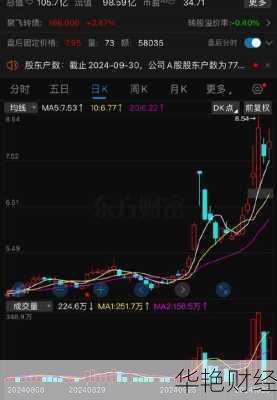

Stock Performance Analysis

Real-Time Data (as of December 20, 2024):

Current Price: 5.21 yuan

Change: +0.02 yuan

Percentage Change: +0.39%

Volume: 12.4 ten thousand shares

Turnover: 64.74 million yuan

Total Market Value: 6.82 billion yuan

Circulating Market Value: 5.46 billion yuan

Amplitude: 2.31%

Turnover Rate: 1.19%

Price-to-Book Ratio: 1.02

Price-to-Earnings Ratio: 11.77

Recent Stock Movement: On January 27, the stock was in a state of market close, with a price of 4.89 +0.07 +1.45%.

Insights: For QQ users, the website allows to set up QQ alerts for stock prices.

Financial Health Analysis

2024 Interim Report: For the first half of 2024, Nanjing Pharmaceutical reported revenue of 27.232 billion yuan, a slight decrease of 0.41% compared to the same period last year. Net profit attributable to shareholders was 311.321 million yuan, an increase of 0.87%.

Assets and Equity: As of the end of the reporting period, total assets were 31.655 billion yuan, an increase of 11.42% compared to the end of last year. Net assets attributable to shareholders of the listed company were 6.544 billion yuan, an increase of 1.70%.

Earnings Per Share: Basic earnings per share were 0.240 yuan, an increase of 1.27%.

Cash Flow: Net cash flow from operating activities was -2.352 billion yuan.

Profit Distribution: The company's 2023 profit distribution plan was approved at the 2023 Annual General Meeting on May 31, 2024, with a cash dividend of 1.60 yuan (including tax) per 10 shares distributed to all shareholders.

Solvency: The company issued multiple series of medium-term notes.

Q3 2024 Report: Nanjing Pharmaceutical's 2024 Third Quarter Report was released.

Operational Strengths: Evident business structure adjustments and enhanced profitability.

Industry and Market Position

Core Business: Nanjing Pharmaceutical operates primarily in pharmaceutical distribution and logistics. Its main products include pharmaceuticals, medical devices, and healthcare products.

Enterprise Nature: Being a state-owned enterprise grants the company certain advantages but also subjects it to specific reform policies and requirements.

Market Influence: The company is an important enterprise in the national pharmaceutical supply chain, playing a key role in ensuring drug supply and safety.

Strengths and Advantages: Nanjing Pharmaceutical possesses a comprehensive pharmaceutical supply chain system, efficient distribution capabilities, and a wide range of pharmaceutical products.

Key Strengths, Weaknesses, Opportunities, and Threats (SWOT Analysis)

Strengths:

State-Owned Enterprise (SOE) Status: Benefits from government support and stable relationships.

Established Distribution Network: Extensive network ensures efficient product delivery.

Comprehensive Product Range: Wide selection of pharmaceuticals and healthcare products.

Weaknesses:

Cash Flow: Negative net cash flow from operating activities may raise concerns.

Opportunities:

SOE Reform: Potential for improved efficiency and market responsiveness.

Growing Healthcare Market: Increasing demand for pharmaceuticals in China.

Threats:

Market Competition: Intense competition in the pharmaceutical distribution sector.

Policy Changes: Regulatory changes in the pharmaceutical industry.

Investment Considerations

Financial Indicators: Investors should monitor key financial indicators such as revenue growth, profitability, cash flow, and debt levels to assess the company's financial health and growth potential.

Market Trends: Understanding the trends and changes in the pharmaceutical industry is crucial for evaluating the company's prospects.

Risk Factors: Investors should be aware of the risks associated with the pharmaceutical industry, such as policy changes, market competition, and quality control issues.

Analyst Reports: Reviewing analyst reports and ratings can provide valuable insights into the company's performance and future outlook.

Conclusion

Nanjing Pharmaceutical Co., Ltd. is a significant player in the pharmaceutical distribution industry, with a solid market position and a wide range of products. Its status as a state-owned enterprise provides both advantages and challenges. While the company has demonstrated steady growth in revenue and profitability, investors should closely monitor its cash flow, market competition, and policy changes. A comprehensive understanding of these factors is essential for making informed investment decisions regarding Nanjing Pharmaceutical's stock.

评论留言