德赛电池股票—德赛电池股票最新分析

Here's an analysis of Shenzhen Desay Battery Technology Co., Ltd. (德赛电池, 000049.SZ), incorporating recent stock performance, financial data, and business overview.

Overview of Desay Battery (德赛电池, 000049.SZ)

Shenzhen Desay Battery Technology Co., Ltd. (深圳市德赛电池科技股份有限公司) is a Chinese company engaged in the production and sale of batteries and related accessories. The company's main products include lithium batteries, batteries for consumer electronics, power management systems for power tools, new energy vehicle batteries, and brushless motor control systems. Desay Battery sells its products both in China and overseas.

Stock Performance Analysis

Current Price: On December 24, 2024, Desay Battery's stock price was 24.03 yuan, with a change of +0.27 yuan (+1.14%).

Historical Data:

Previous Close: 23.76 yuan

Day High: 24.13 yuan

Day Low: 23.84 yuan

Volume: 12,698 lots

Turnover: 30.51 million yuan

Total Market Value: 9.24 billion yuan

Circulating Market Value: 9.24 billion yuan

Price-to-Book Ratio: 1.44

Price-to-Earnings Ratio: 21.98

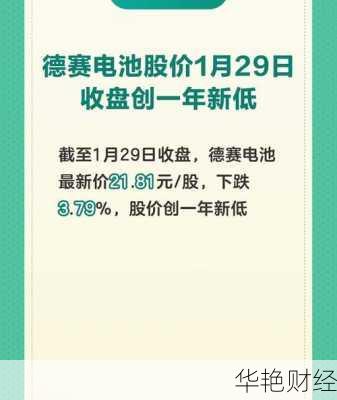

Recent Performance: On January 23, 2025, the stock closed at 22.45 yuan, a decrease of 1.32%.

Shareholder Count: As of January 27, 2025, the company had 385 million total shares outstanding, with 384 million shares in circulation. The average number of shares held per household was 5,886.

Financial Health Analysis

Earnings Per Share (EPS): The company's EPS is reported as 1.12 yuan. Another source states an EPS of 0.84 yuan.

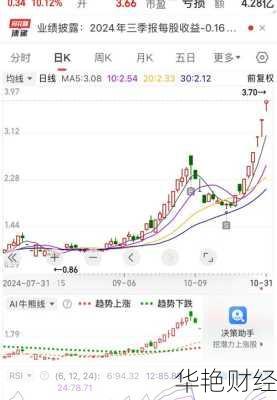

Q3 2024 Results: The Q3 2024 report indicates a basic EPS of 0.2952 yuan, a decrease of 48.95% year-over-year. The cumulative basic EPS for the first three quarters was 0.5750 yuan, a decrease of 48.72%.

Q2 2024 Results: Revenue for Q2 2024 was 4.835 billion yuan, a 7.27% increase year-over-year. Net profit was 21.1742 million yuan, a 77.44% decrease.

Upcoming Earnings Report: Desay Battery is expected to release its next financial report on February 28, 2025.

Key Financial Data from Q3 2024 Report:

ItemAmount (This Period)Amount (Last Year)ChangeReason for ChangeTaxes and Surcharges63,411,391.8442,501,288.3749.20%Increased tax baseFinancial Expenses60,008,854.2424,225,038.16147.71%Decreased exchange gains and increased interestOther Income53,945,851.2323,027,475.93134.27%Deferred income amortization and VAT deductionsInvestment Income28,243,741.99-25,163,858.66212.24%Gains from forward exchange contractsFair Value Change Gain5,093,568.87-1,641,567.24410.29%Increased fair value of trading financial assetsCredit Impairment Loss-4,085,871.331,757,471.68-332.49%Increased provision for bad debt on accounts receivable

Balance Sheet Highlights (End of Period):

ItemEnding Balance (yuan)Beginning Balance (yuan)Long-term Equity Investment5,537,500.976,292,877.48Other Equity Instrument Investment104,820,000.00104,820,000.00Other Non-Current Financial Assets52,668,298.6552,668,298.65Fixed Assets3,720,139,036.863,417,172,575.22Intangible Assets442,729,293.74436,010,605.16Deferred Tax Assets356,320,822.95247,881,013.80Total Current Liabilities7,689,310,765.246,877,237,730.30Long-term Borrowings2,542,062,620.812,939,485,850.54Deferred Income206,301,310.39211,880,274.24

Cash Flow Highlights:

ItemAmount (This Period)Amount (Last Year)Interest Expenses140,860,286.05422,124,656.35Interest Income78,273,618.49371,592,205.47Proceeds from Borrowings2,024,082,776.093,287,339,089.90Cash Paid for Debt Repayment2,054,492,036.092,747,486,512.06Cash Paid for Dividends, Profits375,753,615.33555,088,611.85

Business Overview

Desay Battery operates in the battery industry, which is closely tied to the growth of consumer electronics, electric vehicles, and other battery-powered devices. As a result, the company's performance is influenced by trends in these sectors.

Factors to Consider

Upcoming Earnings Report: Investors should pay close attention to the upcoming earnings report on February 28, 2025, to gain a better understanding of the company's recent performance and future outlook.

Profitability: The Q3 2024 report shows a significant decrease in EPS compared to the previous year. This trend warrants further investigation to determine the underlying causes and potential impact on future profitability.

Financial Expenses: The substantial increase in financial expenses, driven by decreased exchange gains and increased interest, should be monitored closely.

Cash Flow: Analyzing the company's cash flow from operations, investing, and financing activities is crucial for assessing its financial stability and ability to fund future growth.

Conclusion

Desay Battery is a player in the battery industry with a diversified product portfolio. While the company operates in a sector with growth potential, recent financial results indicate a decline in profitability. Investors should carefully analyze the company's upcoming earnings report and monitor key financial indicators to make informed investment decisions.

评论留言