江苏吴中股票 江苏吴中股票估计能涨到多少

Here's an analysis of Jiangsu WuZhong Pharmaceutical Group Co., Ltd. (江苏吴中, 600200.SH), focusing on its potential stock price appreciation.

Overview of Jiangsu WuZhong Pharmaceutical Group (江苏吴中, 600200.SH)

Jiangsu WuZhong Pharmaceutical Group Co., Ltd. is a pharmaceutical company with a diversified business portfolio including pharmaceuticals and medical aesthetics.

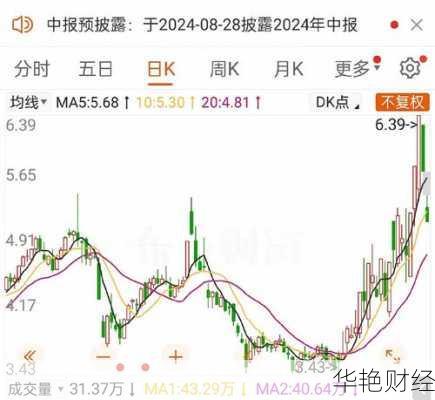

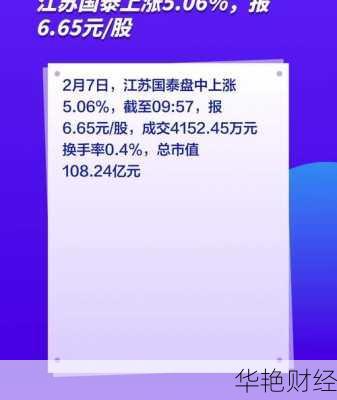

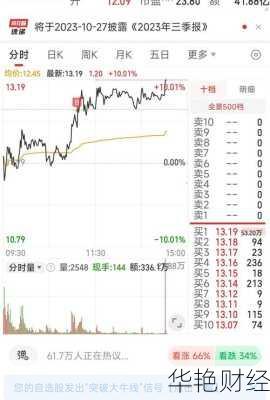

Stock Information (as of February 8, 2025)

To accurately assess the potential stock price appreciation, it's crucial to monitor real-time stock data. However, based on the provided search results, here's a summary of recent performance and analyst estimates.

Factors Influencing Stock Price

Several factors influence the stock price of Jiangsu WuZhong:

Financial Performance: Revenue growth, profitability, and earnings per share are key drivers.

Medical Aesthetics Business: The performance and growth potential of its medical aesthetics segment significantly impact investor sentiment.

Pharmaceutical Business: The traditional pharmaceutical business contributes to revenue but faces毛利率压力.

Analyst Ratings and Estimates: Analyst ratings and target prices reflect professional opinions on the stock's potential.

Market Conditions: Overall market trends and investor sentiment in the pharmaceutical and medical aesthetics sectors affect the stock.

Risk Factors: Potential product launch failures, market volatility, regulatory changes, and failure to meet sales targets can affect stock performance.

Financial Performance and Estimates

2023 Performance: In 2023, Jiangsu WuZhong's revenue increased by 10.55% to 2.24 billion yuan, but it experienced a net loss attributable to shareholders of 71.95 million yuan.

2024 Q1-Q3 Performance: For the first three quarters of 2024, the company reported revenue of 1.647 billion yuan (up 9.58% year-over-year) and net profit attributable to shareholders of 45 million yuan (up 311.54% year-over-year). The medical aesthetics business contributed 199 million yuan in revenue with a high gross margin of 82.17%.

2024 Estimates:

One source estimates 2024 EPS of 0.14 yuan and net profit of 101 million yuan, representing a 240% year-over-year increase in EPS.

Another source (BOC International Securities) estimates 2024 net profit attributable to the parent company to be 80 million yuan, and EPS to be 0.11 yuan.

2025 and 2026 Estimates: BOC International Securities estimates net profit attributable to the parent company to be 190 million yuan in 2025 and 307 million yuan in 2026, with corresponding EPS of 0.27 yuan and 0.43 yuan, respectively.

Analyst Ratings and Price Targets

BOC International Securities: Maintained a "Buy" rating on October 23, 2024. They cited the company's improved profitability and the strong performance of its medical aesthetics business.

Everbright Securities: Upgraded Jiangsu WuZhong’s rating to "Buy" on January 15, 2025.

Valuation: As of October 21, 2024, the closing price implied a P/E ratio of 97.4x for 2024, 41.1x for 2025, and 25.5x for 2026. These valuations suggest that the stock's price already reflects expectations of future earnings growth, particularly from the medical aesthetics segment.

Medical Aesthetics Business

The medical aesthetics business is a key growth driver for Jiangsu WuZhong:

AestheFill: The company actively promotes AestheFill.

Humedix Product: A new injectable hyaluronic acid product is in the clinical trial data consolidation phase.

PDRN Product: WuZhong Aesthetics has exclusive rights to a "PDRN" composite solution product through an investment agreement with Lilaire Technology.

Risks

Product Launch Risk: The risk that new products may not be successfully launched.

Market Volatility: Fluctuations in consumer demand and overall market conditions.

Regulatory Changes: Changes in regulations affecting the pharmaceutical and medical aesthetics industries.

Competition: Increased competition in the pharmaceuticals and medical aesthetics markets.

Potential Stock Price Appreciation

Estimating the exact stock price that Jiangsu WuZhong can reach is speculative. Factors that could drive the stock price higher include:

Stronger-than-Expected Growth in Medical Aesthetics: If the company's medical aesthetics products gain significant market share and generate substantial revenue and profit, the stock price could increase.

Successful Product Launches: Successful launches of new pharmaceutical and medical aesthetics products.

Improved Profitability: Improving gross margins and net profit margins in both the pharmaceutical and medical aesthetics segments.

Positive Analyst Upgrades: Further upgrades from analysts, based on strong performance and future prospects.

Conclusion

Jiangsu WuZhong has potential for stock price appreciation, particularly driven by its medical aesthetics business. However, investors should carefully consider the risks and uncertainties involved. Closely monitoring the company's financial performance, product development pipeline, and market conditions is crucial for making informed investment decisions. Based on current analyst estimates and market conditions, a conservative approach to estimating potential stock price appreciation is warranted.

评论留言